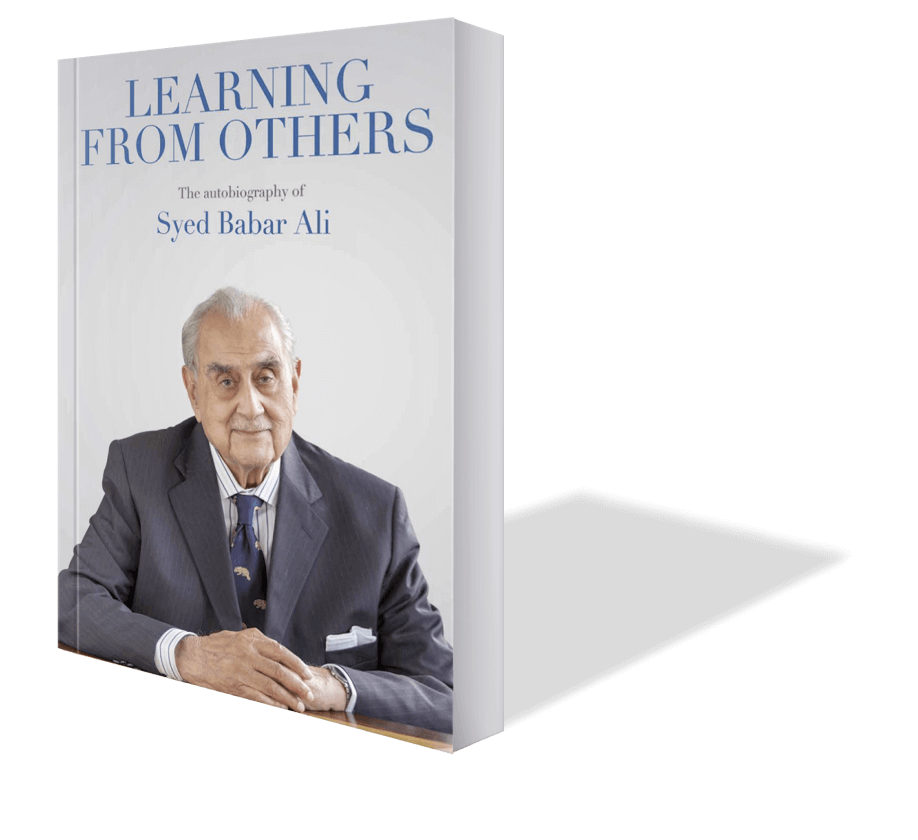

Syed Babar Ali

Non-Executive Director/ Chairman

Syed Hyder Ali

Non-Executive Director

Mr. Arshad Ali Gohar

Non-Executive Director

Syed Anis Ahmad Shah

Independent Director

Mr. Imtiaz Ahmad Husain Laliwala

Executive Director / Chief Executive

Mr. Salman Burney

Independent Director

Mr. Sajjad Iftikhar

Executive Director / Chief Executive

Ms. Saadia Naveed

Independent Director

Ms. Iqra Sajjad

Non Executive Director

Hoechst was one of the larger chemical giants that emerged from the breaking up of the German chemical conglomerate, I.G. Farben after the Second World War. Hoecsht aggressively took to setting up companies outside Germany and this initiative was led by Mr. Kurt Lanz, the senior director for the Central Board of Hoechst. I was fortunate enough to get to know him rather well and visited him in Frankfurt every year till he retired from the Company....

Hoechst had a pharmaceutical operation in what was then East Pakistan and wanted a base in West Pakistan. When they were looking for a local partner in 1971, they asked Fergusons, the Auditors, for recommendations. Fergusons asked me if I would like to meet them and I said I would. It was to be a private limited company and I readily accepted an equity share of 20%. They sent a lawyer and I remember he very hesitatingly said, ‘Mr. Babar Ali, we would like to make an agreement with you’. He gave me the contract and there was a clause that read (paraphrased) ‘If Mr. Babar Ali dies, Hoechst has the right to buy his shares’. I said this was not fair at all and not acceptable to me. First of all, they should cut out ‘if’ and put in ‘when’ regarding my death. I said, ‘This clause will deprive my family. They will not only lose their father but also their shares in Hoechst! Why cannot my family inherit my shares?’ Hoechst accepted that this was reasonable. The company was set up and the main plant was built in the then new industrial estate in Korangi.

In 1999, Hoechst went through a big transformation. They sold off their chemical operation to Clariant, the Swiss company. Their Crop Science business merged with Bayer A.G.’s pharmaceutical company Rhone-Poulenc, becoming Aventis, with the headquarters moved from Frankfurt to Strasbourg. Aventis then bid for the French pharmaceutical company Sanofi but the French did a reverse buy out! The French government didn’t allow Sanofi to be sold because the Louis Pasteur Institute was part of Sanofi and they felt that this made it the world’s Mecca of vaccines. The French government, therefore, provided support to Sanofi to buy out Aventis, becoming Sanofi-Aventis in 2004. Consequently, in Pakistan the original Hoechst Pakistan Limited has ended up as Hoechst Pakistan Limited, only concentrating on the pharmaceutical business, while the crop sciencebusiness became Bayer CropScience Pakistan Limited. As I had 20% equity in the original Hoechst Pakistan Limited, we ended up with slightly less equity in the merged Hoechst Pakistan Limited and a similar proportion in Bayer CropScience Pakistan Limited.

Mr. Dominik von Winterfeldt was the first Managing Director of Hoechst Pakistan and I have enjoyed his friendship to this day. After his transfer from Pakistan, he eventually became the head of Hoechst in the U.K. and some years later he retired to start a head-hunting company in Germany. Aventis Pakistan is now Sanofi-Aventis and its shares, traded on the Karachi Stock Exchange, are much sought after.